Online Banking & Reconciliation

Settle payments faster & move money easier with Striven.

Online Banking Done Right

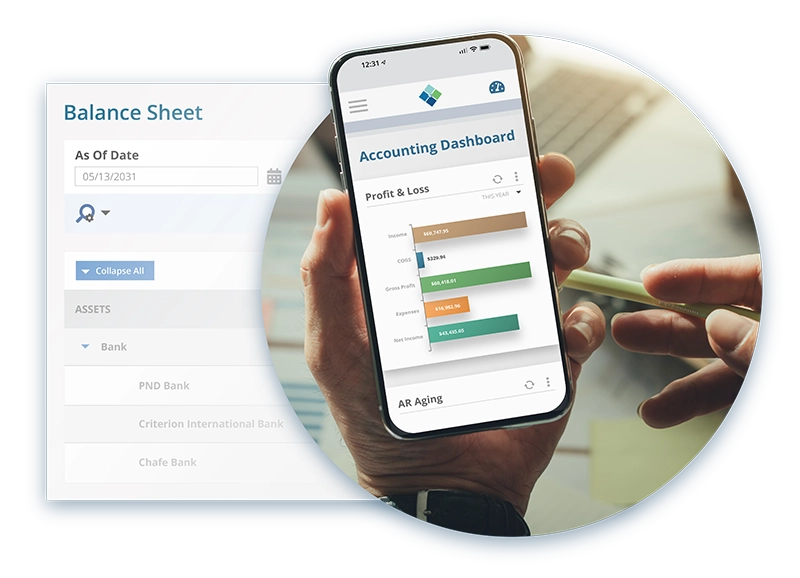

Striven offers an Online Banking integration through Yodlee, enabling you to seamlessly sync transactions from your bank and credit card statements into Striven.

- Fund Transfers

- Checks & Payments

- Deposits

- Reconciliations

- Merchant Accounts

- E-Signatures

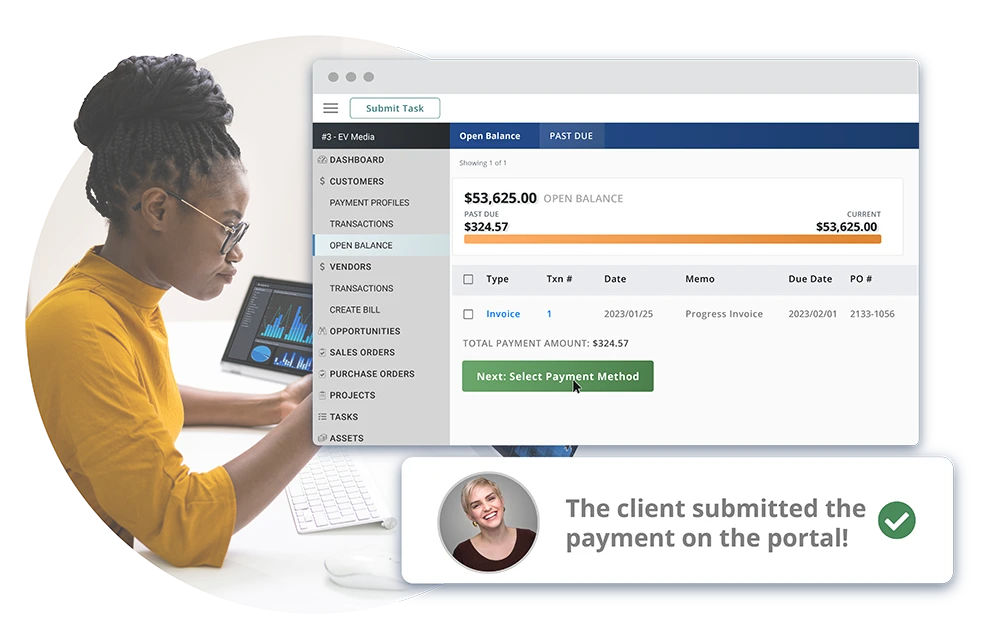

Payment Processing Made Easy*

Whether you sell products, provide services, or have a nationwide eCommerce presence,

Striven’s online banking lets you be more flexible when accepting and processing payments.

*Striven is developed and rigorously tested to be compliant with Generally Accepted Accounting Principles (GAAP).

Fund Transfers

Shift your resources effortlessly, ensuring liquidity is right where it needs to be, when it needs to be.

Checks & Payments

Balance your monetary commitments effectively, making transactions as easy as one-two-three.

Deposits

A secure abode for your funds, giving them the room to grow and thrive.

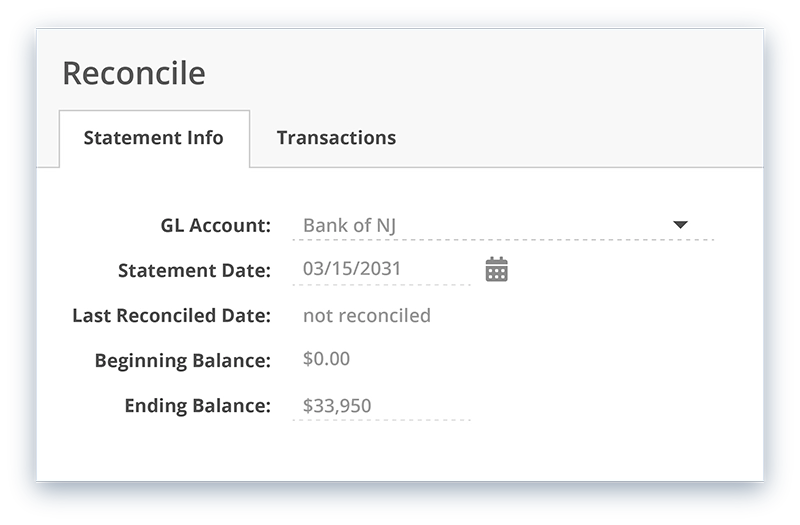

Bank Reconciliations

Harmonize your accounts and transactions, ensuring a flawless financial flow.

Merchant Accounts

An ally for your enterprise, facilitating smooth transactions, quick payouts, and easy account management.

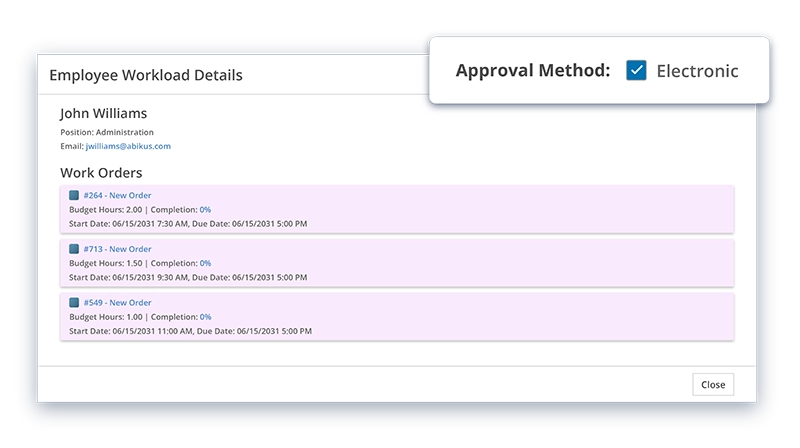

E-Signatures

Assure authenticity with digital convenience, lending credibility and security to your transactions.

“Striven is a great alternative to QuickBooks.”

“Unlike QuickBooks, Striven has a great customer service support team to help with your setup and any future needs.”

—Brandon C, Bookkeeping for General Contractors

Ready to try it? Start here.

Frequently Asked Questions

-

I want to start using Online Banking. How do I link my Accounts?

+

You can link your Accounts by first enabling Online Banking in the Settings. You can then click the Add Accounts button to search for the bank or Credit Card Account you’d like to add, then use your existing online banking credentials to link the Account with Striven.

-

Can Striven handle taxable shipping?

+

Of course. Including tax on shipping charges is as simple as checking the box.

-

Does Striven allow a tax locking date?

+

Certainly. This feature prevents changes or additions being made to transactions prior to a specified lock date.

For added security, if a user does not have the permission in their User Role, Striven will present a popup error message and will not allow the user to create the transaction before the date of the Tax Agency’s Tax Paid Through Date.

-

What happens as sales tax rates change over time?

+

A system message is generated as state or city tax rate percentages change periodically.

-

Can Striven combine both State and City taxes?

+

If you have to include both State and City taxes in certain geographies, then a tax group may be ideal. Create your State Tax Agencies and City Tax Agencies and then group them together with one click.

-

Can Striven create a tax liability report?

+

Easily. Once you’ve set up sales taxes and start selling, you’ll want to keep an eye on your tax liability.

With the Tax Liability Report, you can see how your transactions register both taxable and non-taxable sales, broken down by State, City, or Agency.

-

How do I set up tax authorities in Striven?

+

A tax authority (or agency) is a government entity authorized by law to assess, levy and collect state, city, or other types of sales tax.

Striven has a unique feature when charging taxes in which Agencies will automatically be chosen on transactions based on the Customer Location.

-

Does every sale have to include sales tax?

+

Not all customers in every location need to pay tax on a sales transaction. Schools, churches, and other non-profit organizations are usually exempt.

Striven's Got You Covered

Whatever your business, Striven is here for you, making your workweek just a little easier.