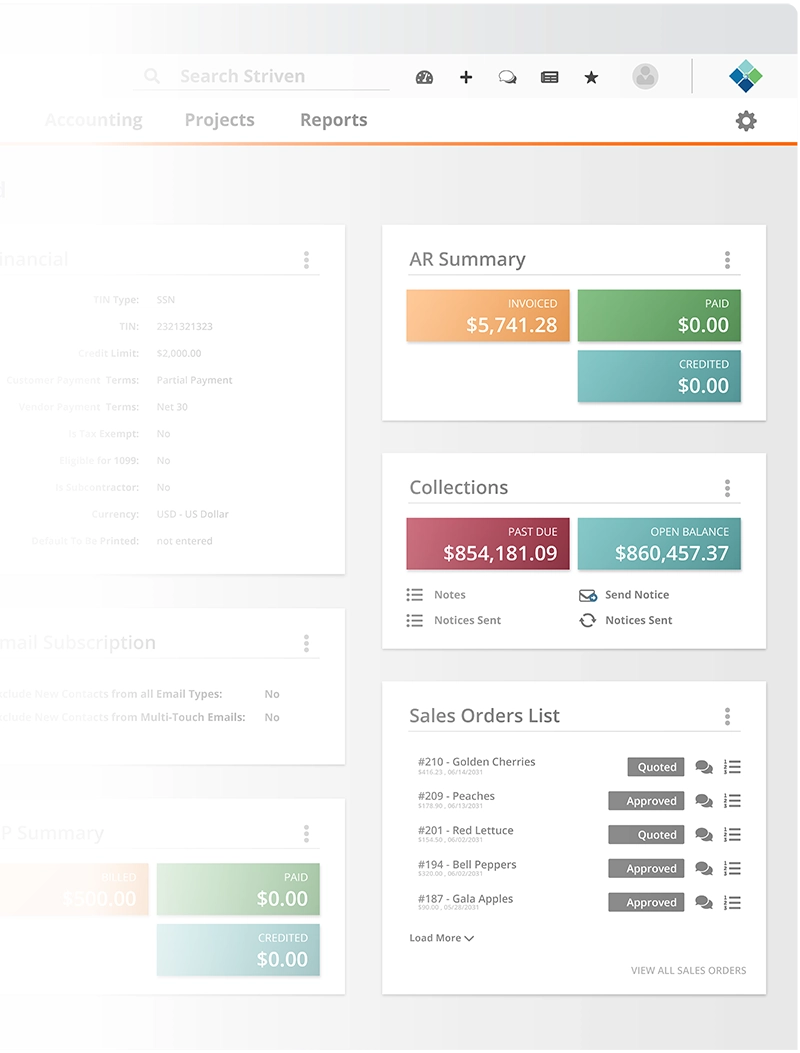

Sales Tax Management

Automatically apply state, city, and custom sales tax rates.

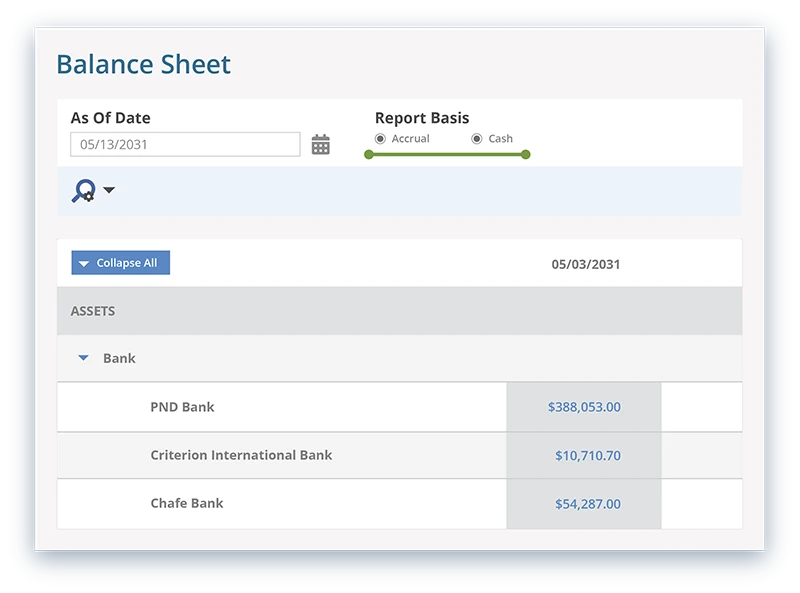

Freedom To Choose How You Record Sales Tax*

Collect tax at the point of sale for goods and services you pay to appropriate taxing authorities over prescribed periods of time. Select accrual or cash basis accounting.

Set up custom Tax Agencies to capture the correct sales tax rate and choose the GL Account from which taxes are owed and paid.

- State Sales Tax

- City Sales Tax

- Other Tax Types

- Taxes Owed

- Taxes Paid

- Taxable Shipping

*Striven is developed and rigorously tested to be compliant with Generally Accepted Accounting Principles (GAAP).

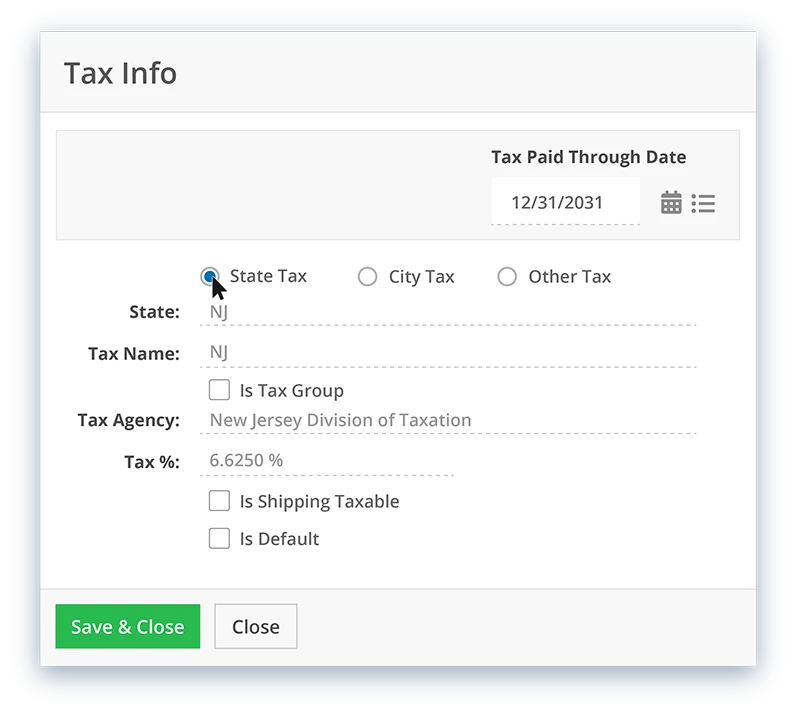

State Sales Tax

Choose a state abbreviation from a drop-down list to associate the correct tax rate for that state.

City Sales Tax

Specify the tax rate at the city level to combine with the state tax.

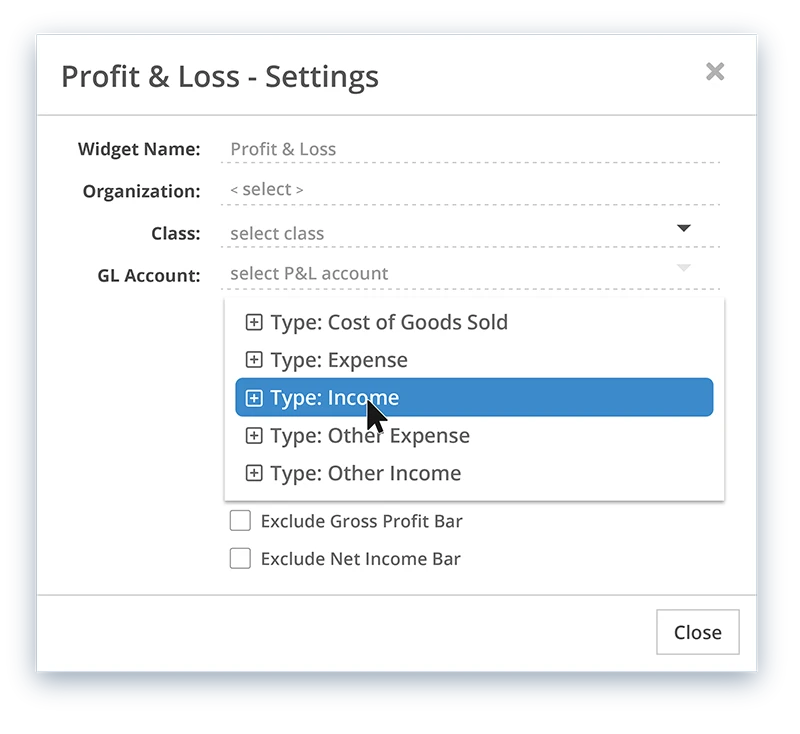

Other Tax Types

For any other type of tax that needs to be noted within your system.

Taxes Owed

Allows you to note when tax is owed. You can choose to owe tax on an Accrual or Cash basis.

Taxes Paid

A default “Taxes Paid” liability GL account is created for convenience.

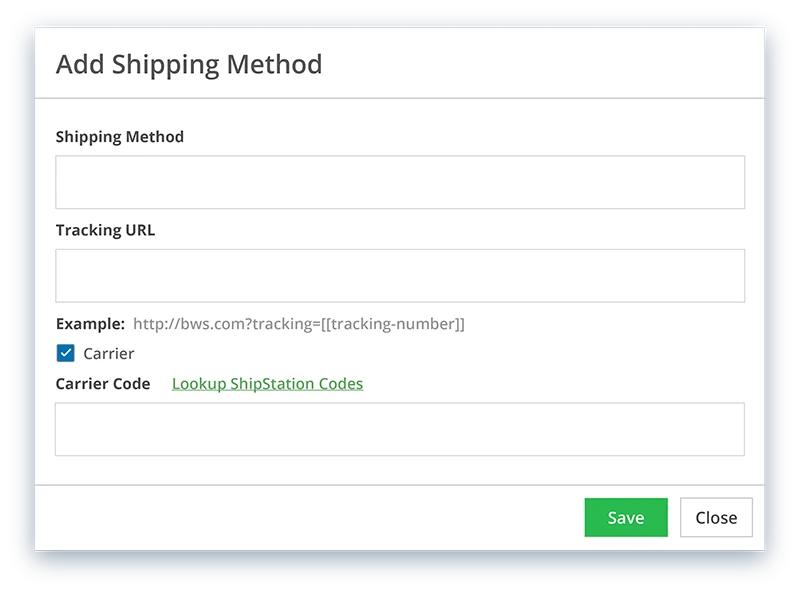

Taxable Shipping

A simple checkbox to make sure that shipping is marked as taxable.

“Striven is a great alternative to QuickBooks.”

“Unlike QuickBooks, Striven has a great customer service support team to help with your setup and any future needs.”

—Brandon C, Bookkeeping for General Contractors

Ready to try it? Start here.

Frequently Asked Questions

-

Can Striven handle every type of sales tax?

+

Yes. Striven allows you to set up Tax Agencies not only for the state, but also for city and/or other taxes as well.

-

Can Striven handle taxable shipping?

+

Of course. Including tax on shipping charges is as simple as checking the box.

-

Does Striven allow a tax locking date?

+

Certainly. This feature prevents changes or additions being made to transactions prior to a specified lock date.

For added security, if a user does not have the permission in their User Role, Striven will present a popup error message and will not allow the user to create the transaction before the date of the Tax Agency’s Tax Paid Through Date.

-

What happens as sales tax rates change over time?

+

A system message is generated as state or city tax rate percentages change periodically.

-

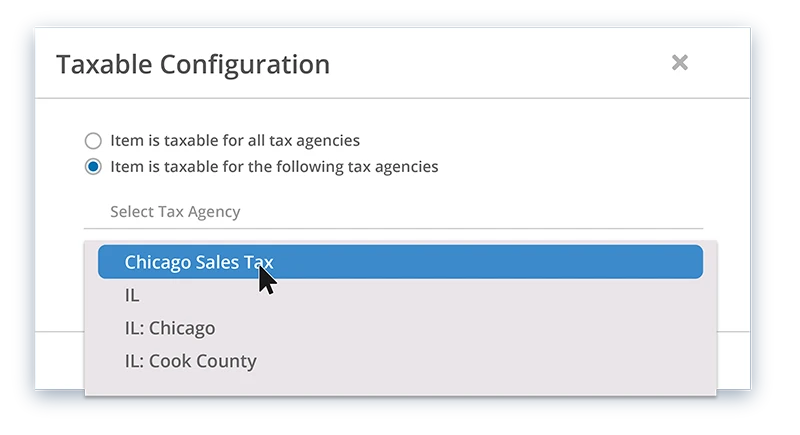

Can Striven combine both State and City taxes?

+

If you have to include both State and City taxes in certain geographies, then a tax group may be ideal. Create your State Tax Agencies and City Tax Agencies and then group them together with one click.

-

Can Striven create a tax liability report?

+

Easily. Once you’ve set up sales taxes and start selling, you’ll want to keep an eye on your tax liability.

With the Tax Liability Report, you can see how your transactions register both taxable and non-taxable sales, broken down by State, City, or Agency.

-

How do I set up tax authorities in Striven?

+

A tax authority (or agency) is a government entity authorized by law to assess, levy and collect state, city, or other types of sales tax.

Striven has a unique feature when charging taxes in which Agencies will automatically be chosen on transactions based on the Customer Location.

-

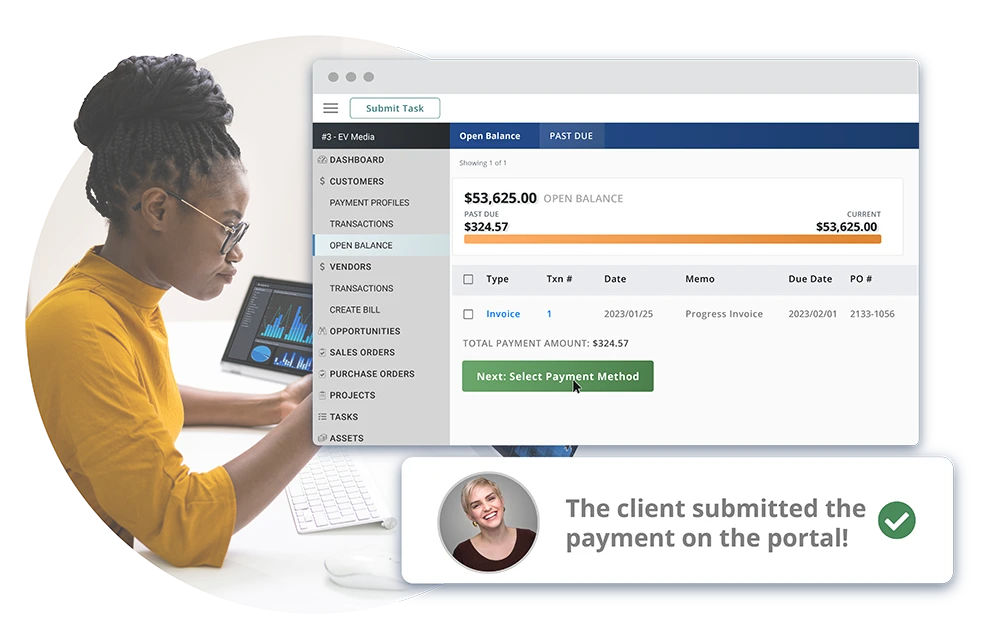

Does every sale have to include sales tax?

+

Not all customers in every location need to pay tax on a sales transaction. Schools, churches, and other non-profit organizations are usually exempt.

Striven's Got You Covered

Whatever your business, Striven is here for you, making your workweek just a little easier.