Cash Flow Management

Flexible, easy-to-use money management tools.

Keep Your Goals In Sight

Don’t just work to stay afloat—help your business grow, manage risk, and increase profit margins.

Streamlined Financial Control

Striven’s integrated cash flow management tools boost operational efficiency, aid in precise financial forecasting, and enable proactive risk mitigation.

- Cash Flow Forecasting

- AP/AR Management

- Budgeting & Planning

- Real-Time Reporting

Cash Flow Forecasting

Predict future cash inflows and outflows based on historical data, current orders, and financial obligations.

Plan for your short-term liquidity needs and long-term financial strategy.

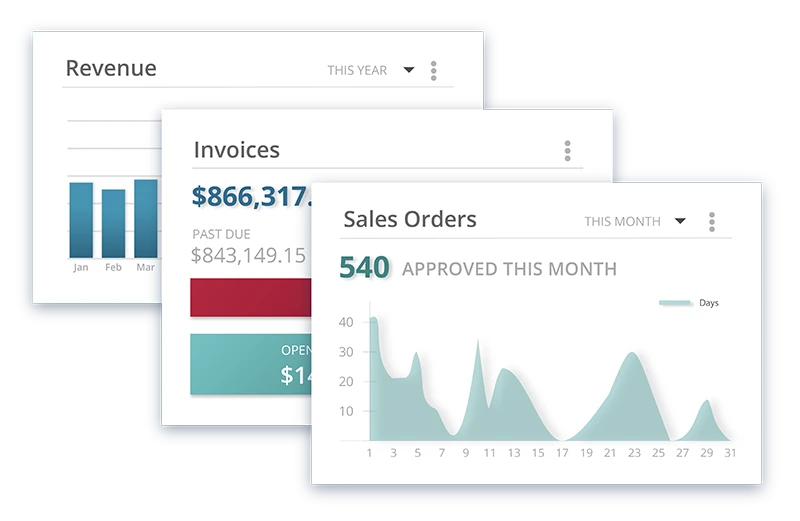

AP/AR Management

Efficiently manage accounts receivable (money owed to your business) and accounts payable (money your business owes).

Track and manage invoices, bills, and payments to ensure timely collections and payments.

Learn more about AP & AR right here.

Budgeting & Planning

Create and manage budgets by comparing actual financial performance against planned budgets, and adjusting plans as needed.

Overall, you’ll gain insight into spending and revenue generation, aiding in your future decision making.

Real-Time Reporting

Access to real-time financial data and reports is essential for timely decision-making.

View PnL statements, balance sheets, cash flow statements, and much more.

You can learn more about reporting right here.

“Striven combines accounting and inventory management into an all-in-one ERP system making your business much more efficient and manageable.”

—Striven User, G2 Review

Ready to try it? Start here.

Frequently Asked Questions

-

What is Striven’s approach to cash flow forecasting in its ERP software?

+

Striven’s ERP software employs historical data analysis to provide accurate and comprehensive cash flow forecasts. This enables businesses to anticipate future financial needs and make informed decisions.

-

How does Striven help in managing accounts payable and receivable?

+

Striven’s ERP offers integrated accounts payable and receivable management, streamlining invoice processing, automating payment reminders, and ensuring timely financial transactions to maintain healthy cash flow.

-

Can Striven assist in budgeting and financial planning for my business?

+

Yes, Striven includes robust budgeting tools that allow for detailed financial planning, real-time budget tracking, and variance analysis, helping businesses stay on top of their financial goals.

-

Does Striven offer real-time financial reporting?

+

Absolutely. Striven provides real-time financial reporting, offering instant access to critical financial documents like cash flow statements, balance sheets, and profit and loss statements, aiding in swift decision-making.

-

How does liquidity management work in Striven’s ERP software?

+

Striven’s ERP software includes liquidity management features that monitor cash reserves, manage short-term investments, and ensure sufficient liquidity for business operations and growth opportunities.

-

How user-friendly is the cash flow management tool in Striven’s ERP?

+

Striven’s cash flow management tool is designed with user-friendliness in mind, featuring an intuitive interface and easy-to-navigate dashboards, making financial management accessible to all users.

-

Can Striven’s ERP software help in identifying financial risks?

+

Yes, Striven’s ERP software includes features that help in early risk identification by analyzing cash flow trends and patterns. This enables businesses to take proactive measures to mitigate financial risks.

-

How does Striven ensure the security of financial data?

+

Striven prioritizes data security with robust encryption, regular backups, and compliance with financial industry standards, ensuring that all financial information is securely managed and protected.

-

Is Striven’s cash flow management tool adaptable to different business sizes and industries?

+

Absolutely. Striven’s ERP software is highly customizable, making it suitable for a wide range of business sizes and industries. It can be tailored to meet specific cash flow management needs and operational demands.

-

How does Striven facilitate decision-making with its cash flow management tools?

+

Striven’s ERP software provides detailed financial analytics and insights, enabling businesses to make data-driven decisions. By offering a clear view of cash flow health, businesses can strategize effectively, manage resources efficiently, and plan for future growth with greater confidence.

Striven's Got You Covered

Whatever your business, Striven is here for you, making your financial management a breeze.