Tax Management

Tax workflows designed to simplify your tax season.

Stress-Free Tax Management

By automating complex calculations and providing real-time compliance updates, Striven ensures that your business stays current with tax regulations while minimizing manual efforts and errors.

- Automatic Tax Calculations

- Tax Reporting & Filing

- Tax Code Updates

- Multi-jurisdictional Tax Management

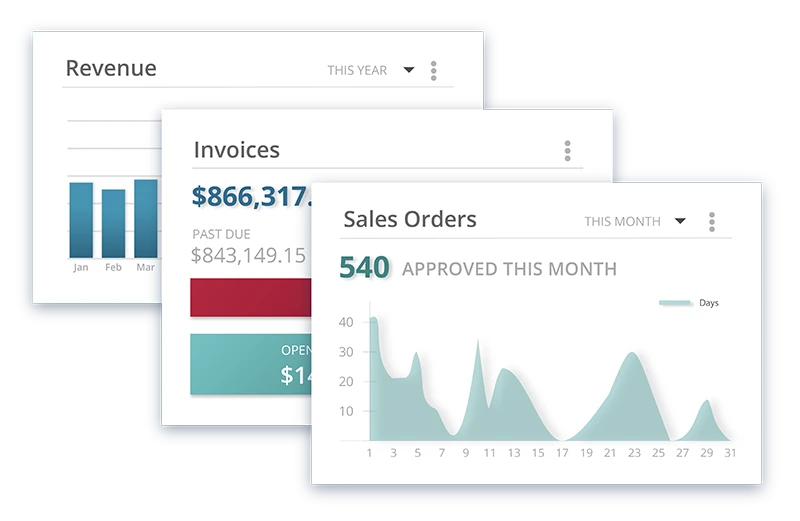

Automatic Tax Calculations

Automatically compute accurate taxes for every transaction, reducing errors and saving time.

Tax Reporting & Filing

Streamline tax reporting and filing, ensuring compliance and on time submissions.

Tax Code Updates

Stay up-to-date with automatic updates to tax codes, keeping your business on top of the latest regulations.

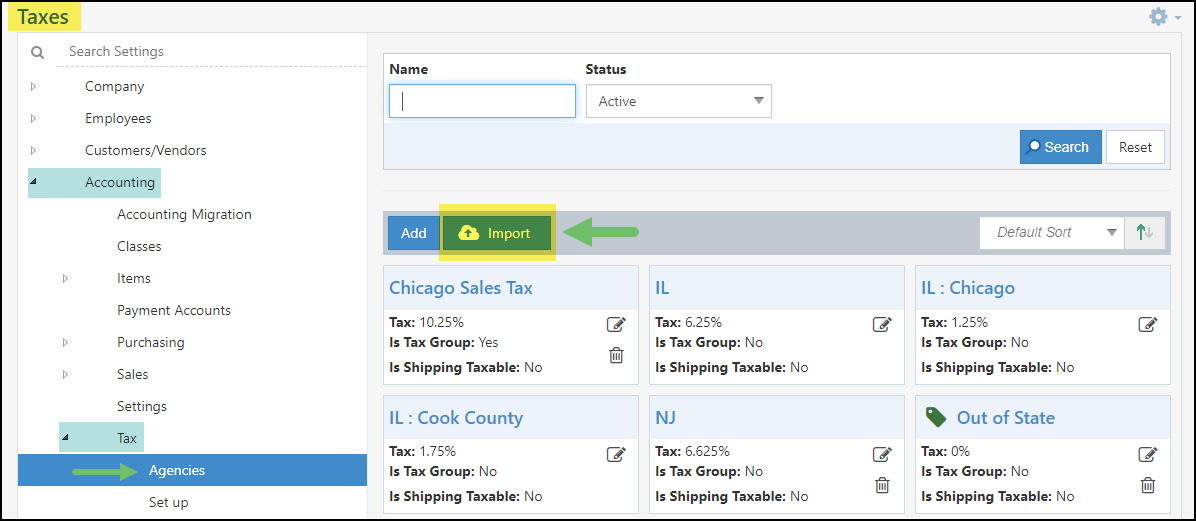

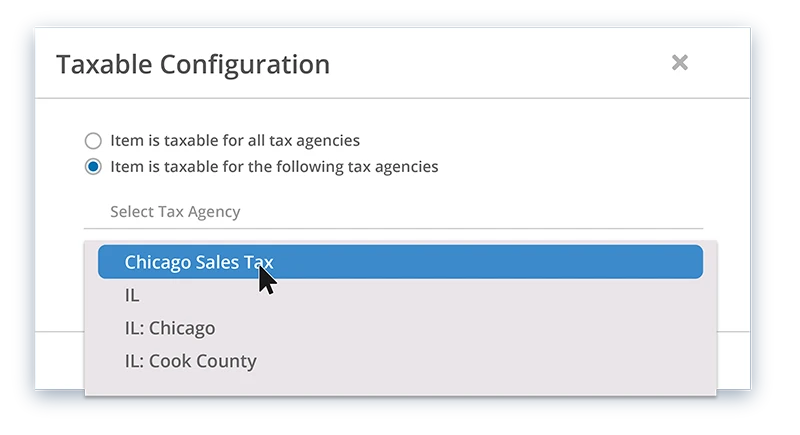

Multi-jurisdictional Tax Management

Effectively manage taxes across different regions, ensuring accurate calculations and compliance with local laws.

“Striven is a great alternative to QuickBooks.”

“Unlike QuickBooks, Striven has a great customer service support team to help with your setup and any future needs.”

—Brandon C, Bookkeeping for General Contractors

Ready to try it? Start here.

Frequently Asked Questions

-

How does Striven ensure accuracy in tax calculations?

+

Striven uses advanced algorithms to automatically apply the correct tax rates based on the product type, customer location, and current tax laws. This reduces manual input and minimizes errors.

-

Can Striven handle tax compliance for multiple jurisdictions?

+

Yes, Striven is equipped to manage tax calculations and compliance for multiple jurisdictions, including federal, state, and local levels, ensuring your business meets all regulatory requirements.

-

What kind of tax reports can I generate with Striven?

+

Striven allows you to generate a variety of tax reports, including sales tax summaries, VAT reports, and jurisdictional breakdowns, all designed to provide comprehensive insights into your tax liabilities.

-

How does Striven adapt to changes in tax laws?

+

Striven’s cloud-based tax law repository is continually updated with the latest regulations, automatically syncing these updates with your system to maintain compliance without manual intervention.

-

Is Striven suitable for businesses with international operations?

+

Absolutely, Striven supports multi-currency transactions and tax calculations for international sales, making it ideal for businesses with a global presence.

-

How can Striven help reduce the risk of tax audits?

+

By providing accurate, real-time tax calculations and maintaining detailed transaction records, Striven reduces discrepancies and anomalies that often lead to audits.

-

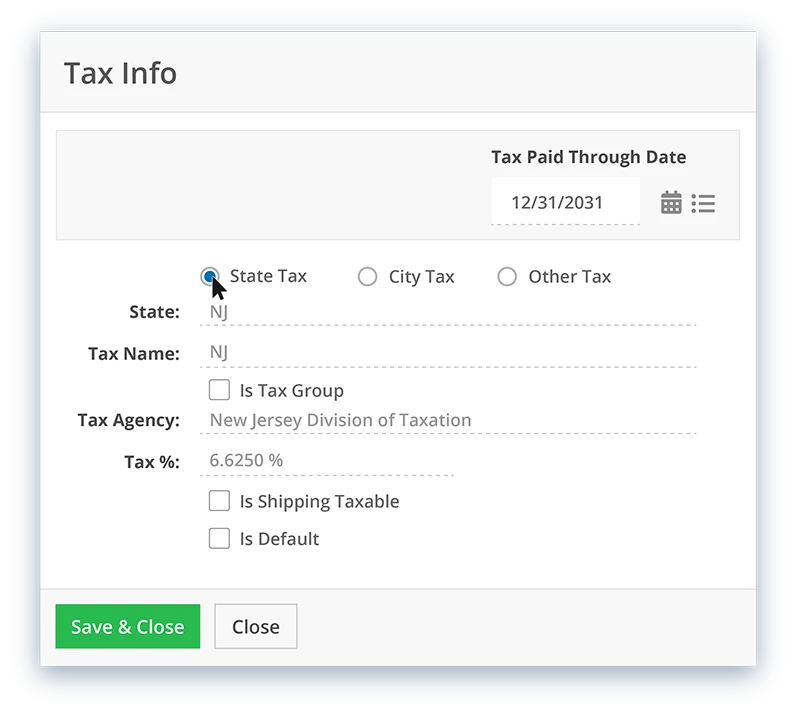

Can I customize tax settings in Striven to fit my business needs?

+

Yes, Striven allows you to customize tax categories, exemptions, and rates to fit the specific needs of your business, providing flexibility and control over your tax management.

-

How does multi-entity support in Striven enhance tax management?

+

Striven’s multi-entity support consolidates tax data from different branches or subsidiaries, giving you a unified view of your tax obligations and streamlining tax preparation across your entire organization.

Striven's Got You Covered

Whatever your business, Striven is here for you, making your workweek just a little easier.