It’s no secret that technology is evolving—and the world of business is changing too. Remote working is on the rise, which is forcing conventional workplaces to pivot the way they work.

One way businesses are changing is in the storage, processing, and collaboration of data. While on-premises ERP (enterprise resource planning) systems were traditionally used, today many businesses are turning to cloud-based business management software, including Mobile Backend as a Service (MBaaS) solutions.

Compared to physical hosting and in-house solutions, these systems are adaptable and easy to use. So how does it work? Put simply, your system is hosted on virtual servers that are easily accessible over the internet. Meanwhile, data is saved on external servers controlled by your service provider rather than on-site servers.

These cutting-edge data centers are properly managed and feature computer resources dedicated to hosting applications such as digital marketing software on several operating systems. So what other benefits does a cloud-based business management software solution provide?

How Does Cloud Computing Work?

With cloud computing, you can run software remotely via the internet without configuring or maintaining your own server infrastructure. So rather than investing in hardware, you only need a web browser and an internet connection to manage your business’s IT systems.

Meanwhile, your cloud computing provider handles the installation, maintenance, and upgrades of the software, servers, operating systems, and network switches that make up your cloud.

What Are the Primary Service Models in Cloud Computing?

Remote desktop hosting and data storage are just some of the many practical applications provided by cloud-computing services. The services on offer are divided into three primary models:

Infrastructure as a Service (IaaS)

With IaaS, you can rent servers, storage space, virtual devices, and even networks from a cloud provider on a pay-as-you-go basis. If you’re a small business, this may be a useful option, as IaaS providers offer flexible infrastructure to handle fluctuating workloads. Examples of IaaS providers include Amazon Web Services, Google Compute Engine (GCE), and Microsoft Azure.

Platform as a Service (PaaS)

PaaS is a model for delivering cloud-hosted applications and infrastructure to developers. This covers everything from web portals to gateway software and APIs. Solutions such as Amazon Web Services’ Elastic Beanstalk and even Facebook are excellent examples.

Software as a Service (SaaS)

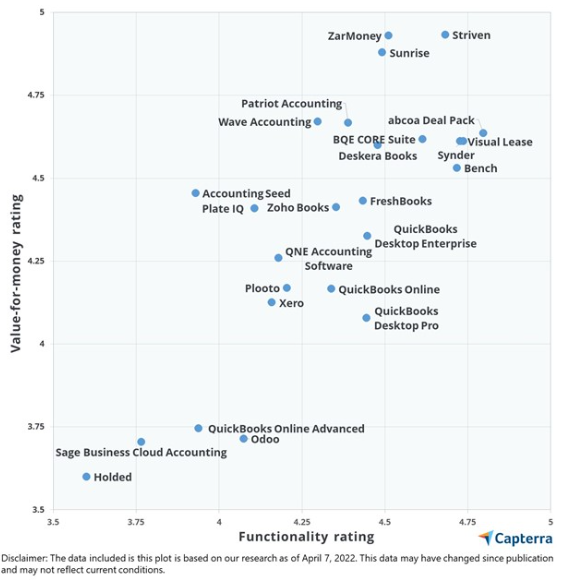

Chances are you’ve used a SaaS tool before – applications include popular services like Netflix, Quickbooks, Zoom, and Google Workspace.

This model offers access to various software through the internet. SaaS applications can be accessed via desktop clients, web browsers, or APIs that interface with the user’s operating system.

Collaborating on projects, sharing data, and accessing specialist software are all made easier with the aid of SaaS applications. Users often pay a recurring cost, either monthly or annually.

8 Benefits of Using Cloud-based Business Management Software

As technology continues to evolve, understanding the latest consumer trends is essential for businesses to stay competitive. One trend that has emerged is remote working, which has forced conventional workplaces to pivot the way they operate. Another area in which businesses are adapting is in the storage, processing, and collaboration of data. This is where cloud-based business management software comes in, providing adaptable and easy-to-use solutions that cater to the latest consumer trends.

The number of companies using cloud computing is growing. In fact, 69% of businesses accelerated their cloud migration in 2022, and that number is likely to grow.

Here are some other top benefits of using cloud-based business management software for your business:

1. Promotes Job Satisfaction

Cloud-based business management software makes managing who has access to what easier, especially if your workforce is increasingly remote. Employees can log in from wherever they are and use whatever device they like, increasing productivity and allowing for greater autonomy and adaptability across the company.

With this consolidated method of interaction, your teams will all be on the same page and more motivated to work together. By empowering employees with more autonomy while retaining the necessary level of control, you can increase job satisfaction and employee retention.

2. Improves Data Accessibility

For employees to be as productive as possible, it goes without saying that they need to access data remotely and in real time. Cloud computing gives employees access to company data from any device with an internet connection. With the right credentials, users get immediate access to data by logging in to a single online hub.

Role-based access is also a feature of certain cloud-based services, ensuring that only authorized users can access sensitive information. These security measures help to ensure that only authorized individuals can gain access to private data. Another advantage is that it enables managers to efficiently manage remote teams, which means that employees in different locations, even across the world, can collaborate on the same projects as their colleagues in the central office.

3. Offers Better Protection

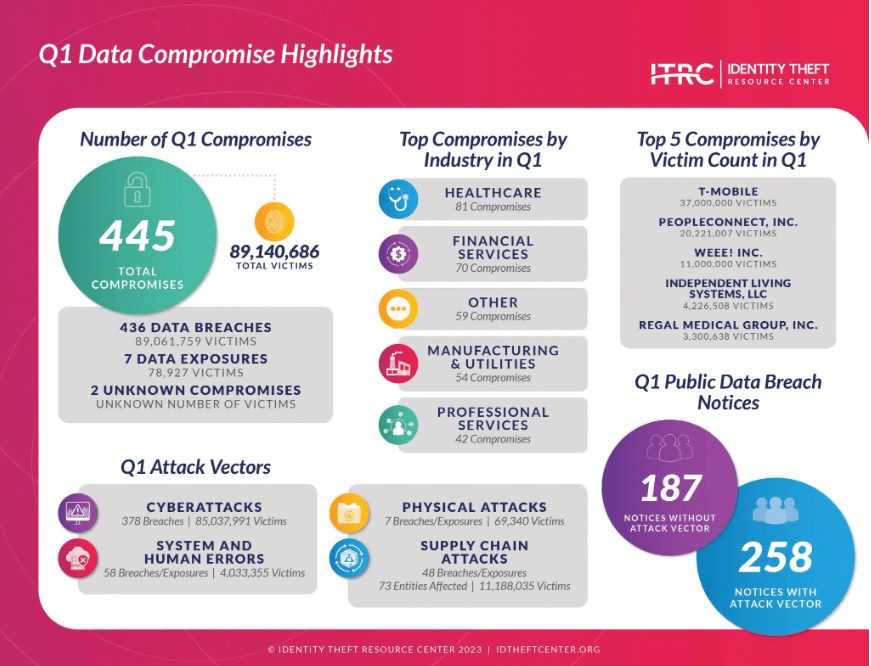

Improving your company’s cyber security practices is essential in modern business, as cyberattacks and hackers pose a threat to corporate data.

By investing in a robust data security process, you can curb data theft and keep sensitive information safe. This means fewer emergencies and maintaining a solid reputation with your employees and customers.

Switching to cloud-based business management software is an excellent approach for strengthening cybersecurity. A cloud-based business management system helps you keep tabs on sensitive information and ensure its safety.

Some methods used by cloud vendors to guarantee data security include the following:

- Data encryption

- Web services security

- The TLS (Transport Layer Security) protocol

- Network IPSs (intrusion prevention systems)

- Multi-factor authentication

- Physical server security

Moreover, software vendors undergo internal and external audits, so your business can be sure that your data is safe and secure.

4. Improves Scalability

No matter the size of your business, change and growth are inevitable, whether it’s setting up a new onboarding system or exploring complex topics like model drift detection. With this in mind, your enterprise management system must be flexible to accommodate such changes.

If you need to add or remove users as your company expands or contracts, you can do it with ease when using cloud-based software.

What’s more, you’ll have far more leeway than you would with a legacy system because of the ability to scale your infrastructure to match business demands. Because you only pay for what you use, there’s no chance of overspending or running out of storage space.

A flexible system that can adapt to technological developments and market shifts is crucial to thriving in competitive marketplaces. When compared to a proprietary system, cloud-based business management solutions’ flexible upgrades and new features are affordable and offer significant growth potential.

Furthermore, cloud-based solutions enable greater opportunities for integration, either between applications from a single provider or third-party software, allowing you to customize your technology to your organization’s specific demands.

5. Offers a Cost-Effective Solution

Cloud management software helps you store data without the hassle of purchasing and maintaining hardware and other equipment. Setting up cloud-based business operations also requires less of an upfront financial commitment than setting up in-house infrastructure and employing a full-time IT department.

The majority of cloud-based services only charge you for your consumption. Like with other services, data storage space is often priced per unit of storage space used. These services are reasonably priced and contribute to reduced costs and a higher ROI.

6. Supports Data Backup and Recovery

Reducing downtime and preventing data loss are key priorities for successful businesses. However, both targets can be difficult to achieve and maintain. Taking measures to limit the severity of data loss and downtime as much as possible is an important first step.

Unnecessary expenses and losses can accrue quickly when even minor problems arise. Data backup and disaster recovery are crucial in the event of unexpected problems. Data recovery and backup functions are built into cloud-based software to mitigate the effects of emergencies such as power outages or natural disasters.

If your company’s data is safely backed up in the cloud, you can rest easy when unexpected situations arise and your system is compromised in any way.

7. Offers Automatic Updates

Speaking of loss of productivity and unanticipated downtime, both are possible results of overlooking software updates.

Traditional software needs regular manual upgrades to function correctly. This is often a tedious, costly, and challenging task that might require an IT professional’s help or input.

By using cloud-based software, your business can benefit from the time savings and peace of mind that come with having the most recent software upgrades applied instantly. This automation eliminates the need for costly and time-consuming third-party IT support. If your employees don’t have to spend time on mundane tasks like maintenance, they’ll have more mental bandwidth for more critical projects.

8. Supports Work Synchronization

It’s easy for mistakes to be made when several people are working on one digital file.

However, if your files are stored on the cloud, you’ll always have access to the most recent version, regardless of what device you’re using and who else is modifying the file.

This feature is valuable for organizations that prioritize continuity in communications, such as a virtual customer service business. Changes are updated in real time and synchronized across all accessible devices, allowing your employees to make key business decisions using the most recent data.

Take Control of Your Business

The best part about cloud computing is that it simplifies complex business systems and saves you time and resources.

You don’t have to struggle to maintain vital business systems by expending scarce IT resources. It handles all that, allowing you to focus on more critical business goals thanks to your cloud computing provider.

Nevertheless, cloud computing also has certain drawbacks that you should be aware of before making the switch. To get the most out of a cloud business management system, it’s important to do your research on the services you’re considering, learn about security measures and compliance requirements, and provide your team with appropriate training on how to use the new system.